Europe’s Coffee Shop Market Grows Amid Challenges in 2024

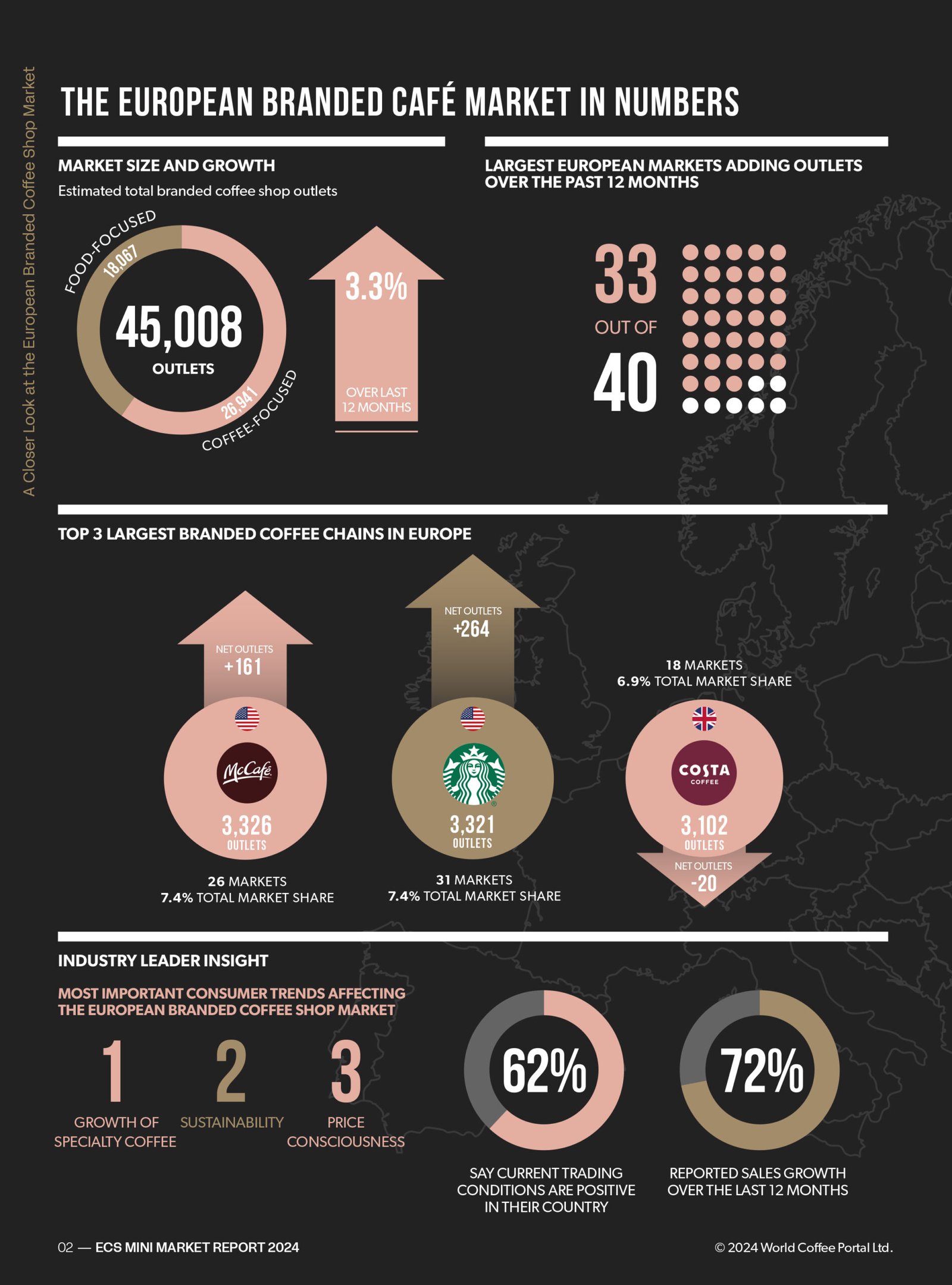

The European branded coffee shop market has shown remarkable resilience and growth over the past year. Despite facing economic challenges, the market has expanded by 3.3%, reaching an impressive 45,008 outlets. This growth is a testament to the industry’s adaptability and the unwavering demand for coffee across Europe.

Market Overview

Over the last 12 months, 33 out of 40 major European markets achieved net outlet growth. The market is divided into 26,941 coffee-focused outlets and 18,067 food-focused outlets, with 695 unique branded coffee chains operating across the continent.

Industry Performance

The sentiment among industry leaders is largely positive. According to recent surveys:

- 62% of industry leaders report that current trading conditions in their countries are favorable.

- 72% have seen sales growth over the past year.

- 42% believe that trading conditions will improve in the next 12 months.

- Nearly three-quarters of industry leaders see further growth potential for branded coffee chains in their markets.

Top Chains

The leading chains in the European coffee shop market continue to expand:

- Starbucks: With 3,326 outlets across 26 markets, Starbucks holds a 7.4% market share and has added 161 net outlets.

- Costa Coffee: Also with a 7.4% market share, Costa Coffee has 3,321 outlets across 31 markets, adding 264 net outlets.

- McCafé: Operating 3,102 outlets across 18 markets, McCafé holds a 6.9% market share but saw a net loss of 20 outlets.

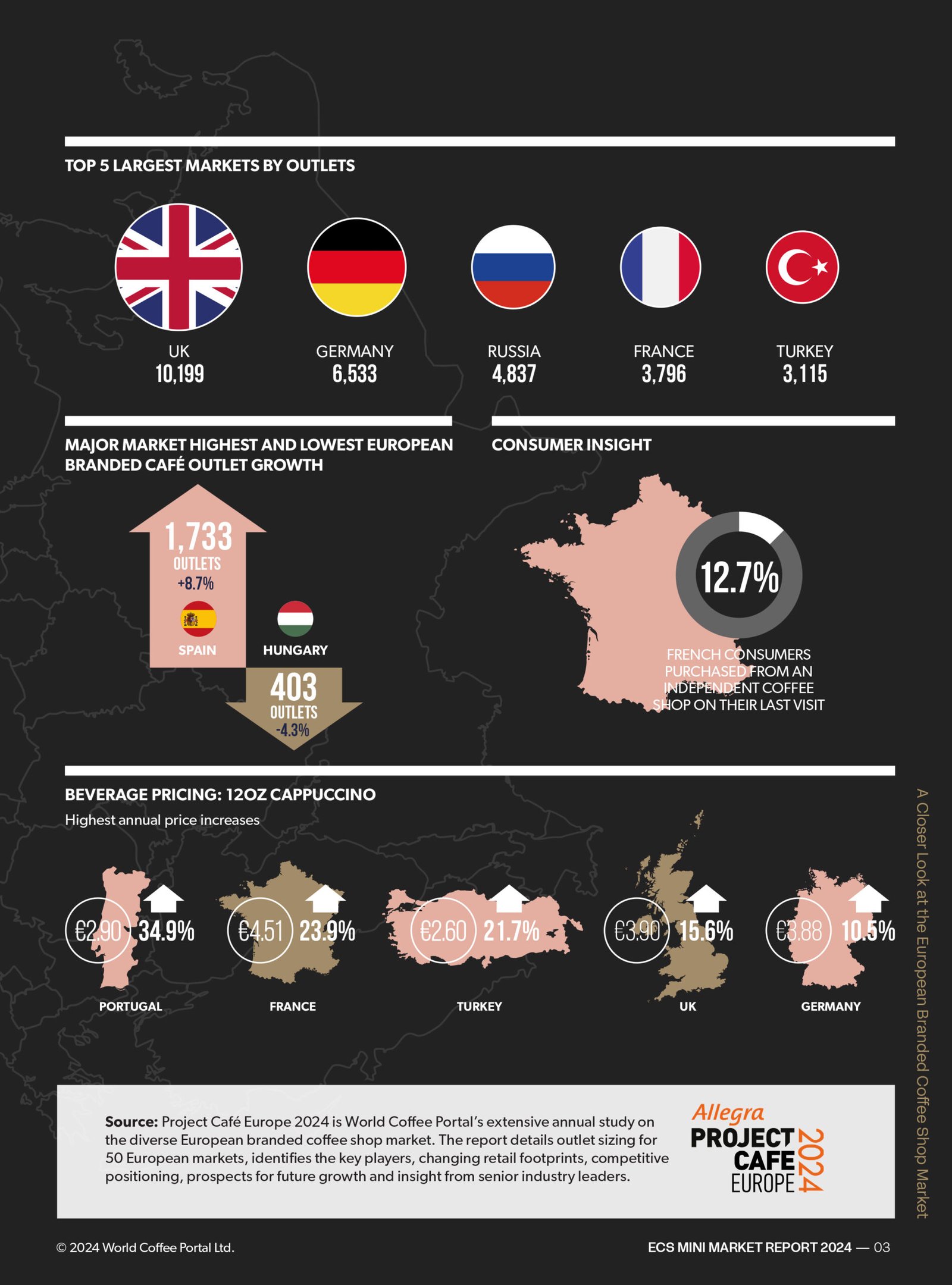

Largest Markets by Outlets

The top five markets by the number of outlets are:

- United Kingdom: 10,199 outlets

- Germany: 6,533 outlets

- Russia: 4,837 outlets

- France: 3,796 outlets

- Turkey: 3,115 outlets

Key Consumer Trends

The European coffee shop market is influenced by several key consumer trends:

- The growth of specialty coffee.

- Increased focus on sustainability.

- Heightened price consciousness among consumers.

Pricing Insights

The average price for a 12oz cappuccino across Europe is €3.61. The highest price increases were observed in:

- Turkey: 21.7%

- Portugal: 34.9%

- France: 23.9%

- United Kingdom: 15.6%

- Germany: 10.5%

Country-Specific Insights

Germany

Germany’s market contracted by 1.3% due to economic challenges. However, premium coffee and bakery chains are focusing on improving coffee quality. Pret A Manger has identified Germany as a key growth market, and many bakery-café chains have implemented reusable coffee cup schemes. Espresso House partnered with Autogrill to expand in airports and railway stations, while Coffee Fellows acquired 25 Waynes motorway service station stores.

France

France saw a 2% growth in outlets, led by coffee-focused chains. The specialty coffee segment is gaining traction, especially in Paris, where 59% of consumers consider specialty coffee crucial to café quality. International brands like Saddle Cafe from Dubai and Ralph’s Coffee from New York have entered the market. Le Paris Café Festival attracted over 10,000 visitors in March 2024, and Coutume Café is seeking regional expansion opportunities.

Poland

Poland’s market grew nearly 5% to 1,170 stores and is forecasted to exceed 2,000 outlets within three years. International chains like Starbucks and Green Caffè Nero are expanding. Research shows that 57% of coffee shop customers spend less than 30 minutes in-store, and more than a third prefer self-service kiosks over counter service. McCafé leads the market with a 30% share, and Lagardère Travel Retail has acquired Costa Coffee franchise rights.

EU Deforestation Regulation (EUDR)

New EU rules coming into force by December 2024 could impact coffee supply and pricing, particularly from countries like Ethiopia. Major companies like JDE Peet’s are already taking action to ensure compliance. The European Coffee Federation has urged for a delay in implementation, and the EU has indicated it might delay the classification of deforestation risk countries.

Industry Challenges

The coffee shop market faces several challenges:

- High operating costs and low consumer confidence in some markets.

- Pressure to demonstrate value-for-money amid rising beverage prices.

- Potential coffee supply issues due to new EU regulations.

- Uncertainty over EUDR implementation and its impact on smallholder farmers.

Market Dynamics

Hungary showed the highest growth at +8.7%, while Spain saw a decline of -4.3%. Convenience and value-focused formats are gaining popularity, and there is an increasing focus on premium and specialty coffee offerings. There is also growing international interest in European markets, particularly for specialty coffee.

The European branded coffee shop market continues to evolve and grow, driven by consumer demand and industry innovation. Despite economic and regulatory challenges, the future looks promising for Europe’s coffee enthusiasts and businesses alike.