India’s Coffee Shop Market Rises as Homegrown Brands Gain Ground

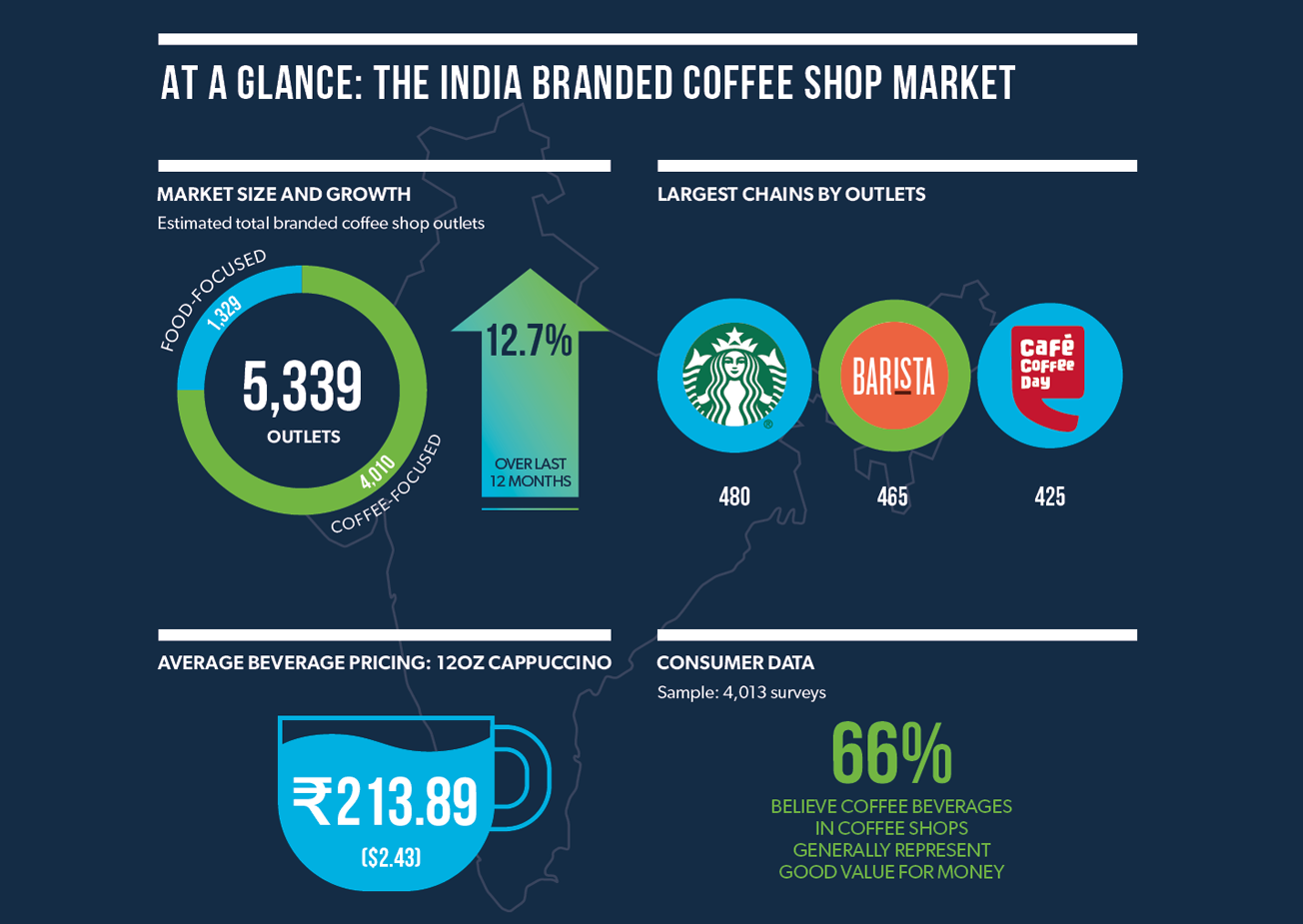

New Delhi, 11 September 2025 – Qahwa World – India’s branded coffee shop sector is undergoing remarkable growth, highlighting both the strength of global players and the rise of domestic champions. New industry data shows the market expanded by 12.7% over the past year, adding more than 600 new outlets to reach a nationwide total of 5,339 branded coffee shops. This surge underscores the growing appetite for café culture in the world’s most populous nation.

Market leaders and shifting dynamics

At the forefront is Tata Starbucks, which operates 480 outlets across India, securing its position as the market leader. It is closely followed by Barista with 465 stores, while Café Coffee Day remains in third place with 425 stores, though it continues to shrink in scale due to financial pressures.

India’s branded coffee landscape is not just defined by large chains. Among the 104 branded operators currently active, nearly four in five are homegrown, demonstrating the growing dominance of domestic brands. Boutique names such as Blue Tokai Coffee Roasters, Third Wave Coffee, and Subko have built reputations by spotlighting India’s coffee-growing heritage, while affordable brands like Nothing Before Coffee, abCoffee, and First Coffee attract younger professionals seeking value-driven options.

Fastest movers in the market

Two local chains stand out for their rapid expansion: Third Wave Coffee and Café Buddy’s Espresso. Each grew by 56 outlets in the past year, bringing their store counts to 172 and 145 respectively. Their rise reflects the strong momentum of Indian-owned businesses as they capture consumer loyalty.

Consumer preferences: social and experiential

Unlike in many Western countries, takeaway culture remains limited in India. Coffee shops are primarily social spaces where family and friends gather, with nearly one-third of visits taking place after 5 p.m. The experience comes at a premium: average spending per visit, including food, is ₹660.86 ($7.53), while beverage-only visits average ₹426.22 ($4.85).

Beyond coffee shops, coffee also plays a growing role in restaurant culture, with nearly 75% of surveyed consumers reporting that they ordered coffee in restaurants over the past year. This has encouraged international players to adapt, with UK-based Pret A Manger launching its first-ever full-service restaurant format in India earlier this year.

A market with global potential

India’s demographics provide fertile ground for future growth. With a population of 1.45 billion, more than half of whom are under 30, and a strong base of coffee-growing regions, the country is poised to become a key global hub for coffee commerce.

Projections indicate that the branded coffee shop market will exceed 6,100 outlets by 2026, and is on track to cross 10,000 outlets by 2030. Analysts forecast a 13.2% compound annual growth rate (CAGR) over the next five years. Coffee-focused chains are expected to expand at 15% CAGR, surpassing 8,050 outlets, while food-led operators will grow at around 7% CAGR, reaching nearly 1,860 stores.

Coffee’s future in India

India’s shift from a tea-first nation to a thriving coffee culture is unmistakable. While global chains such as Starbucks and Costa Coffee initially brought premium café experiences to the country, domestic brands are now setting the pace. By blending modern hospitality with local roots, these operators are shaping India’s evolving identity as a coffee destination.

With rising incomes, urbanization, and a new generation of coffee drinkers seeking aspirational experiences, India is set to become one of the world’s most dynamic coffee markets. From metropolitan hubs like Delhi, Mumbai, and Bengaluru to second- and third-tier cities, coffee culture is spreading fast — and the momentum shows no signs of slowing.