China’s coffee industry is experiencing unprecedented growth, with nearly 12,000 new coffee shops opening nationwide over the past year. This surge reflects a significant shift in consumer behavior, driven by political endorsements, changing lifestyles, and intense market competition.

According to data from food and beverage research platforms, the total number of coffee outlets in mainland China reached approximately 67,000 by the end of 2024. This net increase highlights the growing appeal of coffee not only in major metropolitan areas but also in rapidly developing urban centers known as “new first-tier” cities.

A notable moment came in March 2024 when President Xi Jinping praised coffee produced in Yunnan province, describing it as a product that “represents China.” This endorsement has bolstered the domestic coffee movement, encouraging broader support for local beans and producers.

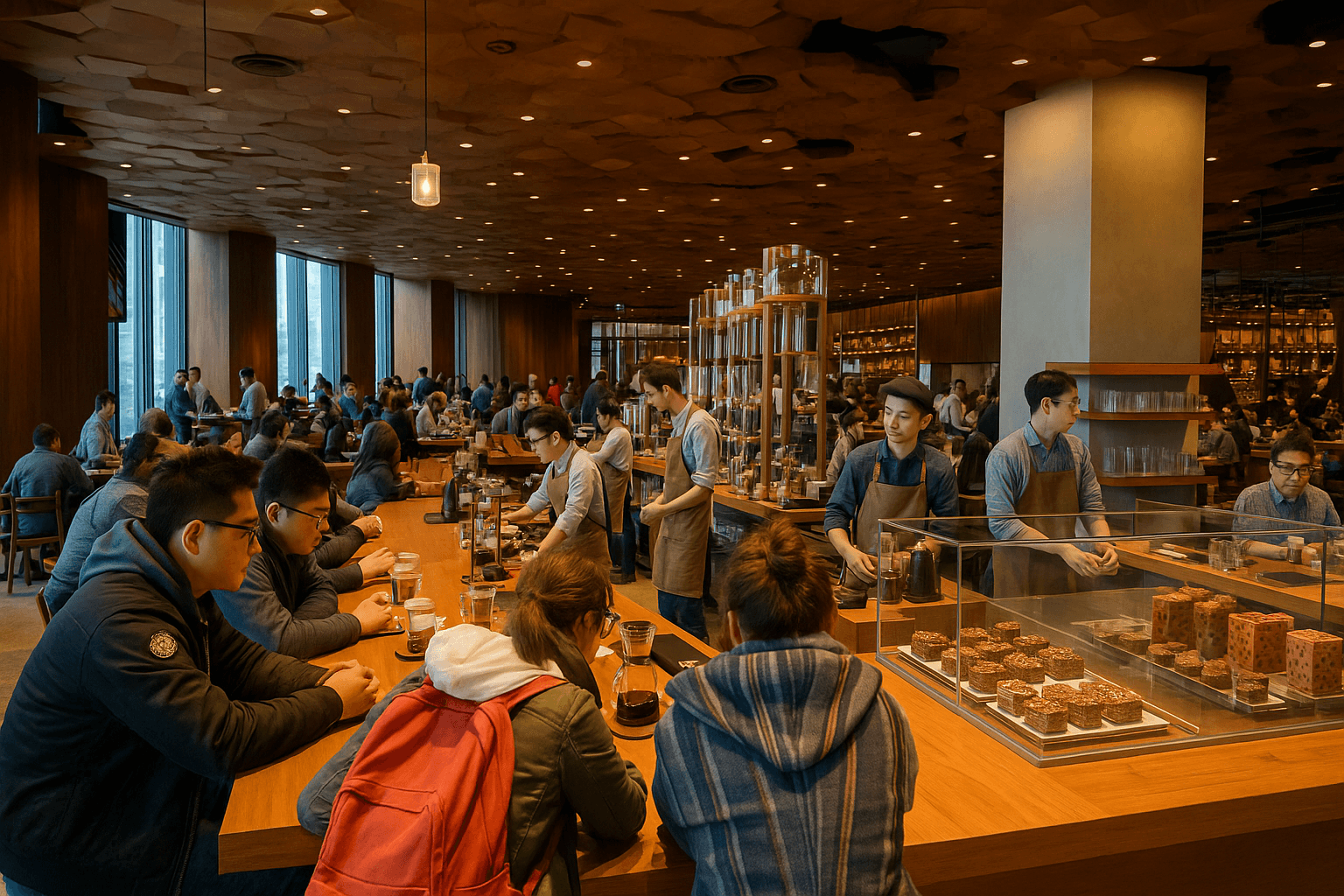

International brands are feeling the pressure. Starbucks, once dominant in China’s coffee market, has seen its market share drop from 34% in 2019 to just 14% in 2024. The company also reported an 8% decline in same-store sales in China for the last fiscal year, highlighting the growing challenge it faces in maintaining relevance among increasingly price-sensitive consumers.

Much of the recent growth in the coffee industry has been driven by local chains offering affordable prices and efficient business models. Among them, Nowwa Coffee has emerged as a key player, operating more than 2,000 outlets across China. According to the company’s founder and CEO, the new wave of coffee drinkers includes not only office workers but also service employees, delivery drivers, and young shoppers—groups that previously relied on energy drinks for a quick boost.

Nowwa’s approach focuses on compact, highly efficient store formats—often just 30–40 square meters—situated inside convenience stores, hotels, and other high-traffic retail locations. This model reduces costs and allows for rapid national scaling. In March alone, Nowwa opened hundreds of new locations and saw a sharp increase in revenue.

China’s coffee industry reached a value of 624 billion yuan (US$86 billion) in 2024 and is expected to surpass 1 trillion yuan this year, according to iiMedia Research. However, the rapid expansion comes with challenges: growing market saturation and intense price competition.

The average cost of a cup of coffee in China dropped by 14% to 28 yuan in 2024, as local chains engage in pricing wars to win over customers. “Competitive price wars and promotions have resulted in loss of profits and the closure of smaller coffee shops,” said Nathanael Lim, Asia-Pacific beverage research lead at Euromonitor.

To adapt, many chains are diversifying their offerings. Popular strategies include introducing tea drinks, snacks, and culturally themed beverages, or opening shops in tourist attractions like temples and historic sites to generate social media interest.

As local brands continue to innovate and expand, global companies must adjust their strategies, deepen localization efforts, and seek meaningful partnerships within the local ecosystem. In China’s fast-moving coffee market, adaptability and cultural relevance are becoming as important as quality and branding.