Global Coffee Market Ends 2024 on a High Note: Price Surges, Export Dynamics, and Emerging Trends

The International Coffee Organization’s (ICO) December 2024 Coffee Market Report revealed significant developments in the global coffee market. From historic price increases to evolving export patterns, the coffee industry closed the year with remarkable changes that are shaping its future.

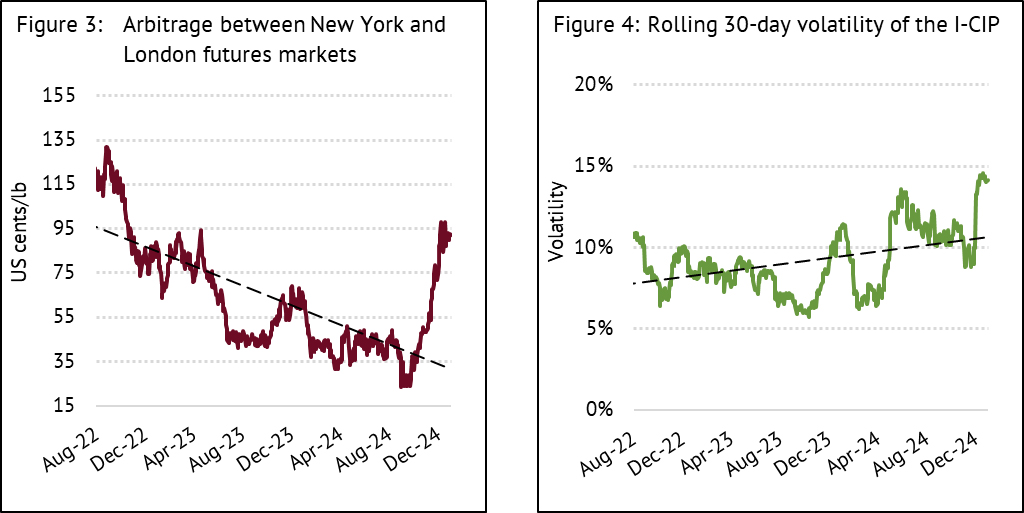

Historic Price Surges Highlight 2024

The ICO Composite Indicator Price (I-CIP) averaged 299.61 US cents per pound in December, marking a 10.7% rise from November and a staggering 70.5% increase year-over-year. This surge set the highest monthly average since April 1977, driven by multiple factors:

- Strong performance of the US dollar, increasing operational costs at origins.

- Supply chain disruptions, including prolonged shipping times and port inefficiencies.

- Regulatory uncertainties tied to the European Union’s delayed deforestation regulation (EUDR).

Arabica varieties led the charge, with Colombian Milds and Other Milds rising by 11.4% and 12.6%, respectively. Brazilian Naturals climbed 14.5%, while Robusta saw a modest 4.7% increase.

Export Dynamics: Mixed Performance Across Regions

Despite price hikes, global green bean exports in November 2024 totaled 9.7 million bags, a slight 0.4% decline year-over-year. Key trends included:

- Robusta exports declined by 17.3%, driven by Vietnam’s 47.1% drop in shipments.

- Colombian Milds surged 13.1%, marking the fourteenth consecutive month of growth, with Tanzania’s exports more than doubling.

- Brazilian Naturals increased by 12.1%, supported by Brazil’s robust performance.

- Africa’s exports grew 24.5%, with Ethiopia leading at an 86.24% increase.

Regional Highlights: Winners and Challenges

- Asia & Oceania: Exports declined by 12%, mainly due to Vietnam’s poor performance, but growth in India and Indonesia offset some losses.

- South America: Exports rose 6%, with Brazil and Colombia showing strong gains, while Peru faced supply shortages.

- Africa: Double-digit growth dominated, driven by Ethiopia, Kenya, and Tanzania.

- Central America & Mexico: Exports increased by 5.2%, led by Costa Rica and Mexico, despite declines in Honduras and Nicaragua.

Supply Chain Struggles and Consumer Implications

Logistical bottlenecks continued to stress the global supply chain:

- Shipping delays, particularly through the Suez Canal, slowed European imports.

- Low certified stock levels (42.5% of the five-year average) exacerbated supply constraints.

These challenges increased costs for roasters and processors, ultimately driving up consumer prices.

Coffee Consumption and Production Balance

Global coffee consumption grew modestly by 2.2% to 177 million 60-kg bags, while production rose by 5.8% to 178 million bags, creating a slight supply surplus. However, the dynamics of Arabica (up 8.8%) and Robusta (up 2.1%) production varied significantly across regions.

Key Insights for 2025

As the coffee market heads into 2025, several trends stand out:

- Regulatory shifts like the EUDR will play a crucial role in shaping trade and sustainability practices.

- The growing Arabica-Robusta price differential could prompt roasters to blend more Robusta into their products.

- Continued investment in logistics and infrastructure will be critical to address persistent supply chain issues.

The ICO’s December 2024 report underscores the resilience and complexity of the global coffee market. With price surges, shifting trade patterns, and evolving regulatory landscapes, stakeholders must navigate a challenging but opportunity-rich environment in the year ahead.