Coffee’s Global Journey: From Traditional Heartlands to New Frontiers

By Dr. Steffen Schwarz (Coffee Consulate) & Qahwa World Editorial Team

Published: August 6, 2025

In the cool pre-dawn of Ethiopia’s highlands, a smallholder farmer tends ancient arabica coffee trees – the same species first brewed by monks centuries ago. Halfway around the world in Vietnam’s Central Highlands, rows of robusta plants line the red soil, a landscape transformed over the past few decades. These scenes underscore coffee’s truly global journey: cultivated in over 80 countries across the Coffee Belt and increasingly consumed everywhere from São Paulo to Shanghai.

This article explores the development of coffee production in both traditional powerhouses and emerging upstarts, while examining how climate change, supply chain turmoil, financial speculation, and evolving consumer trends are reshaping the industry’s future. We delve into how the world’s most beloved bean is grown, traded, and savoured – all through a scientifically grounded lens aimed at coffee professionals and curious journalists alike.

Roots in the Coffee Heartlands

(Original contribution by Dr. Steffen Schwarz)

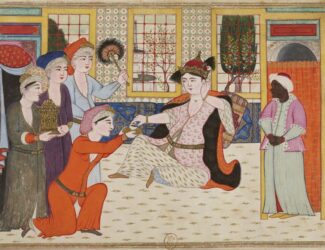

The story of coffee as a global crop begins in the misty forests of southwestern Ethiopia, where arabica coffee evolved and still grows wild. Local legend speaks of Kaldi, the goatherd who discovered his animals prancing after nibbling the red cherries. Whether myth or fact, Ethiopian monks were likely brewing coffee by the 15th century. From Ethiopia, coffee’s cultivation spread to Yemen, where Sufi mystics drank it to fuel midnight devotions.

By the 1600s, coffee had reached Europe’s ports, and colonial powers raced to plant it in suitable tropical colonies. The Dutch established coffee in Java (giving us “java” as slang), the French in the Caribbean, and the Portuguese in Brazil. Thus began a global coffee empire that would shift over the centuries to follow climate and commerce.

Brazil, blessed with vast land and ideal climates, came to dominate coffee like no other country. By the late 19th century, Brazil was the undisputed coffee superpower, producing more than half the world’s supply – a status it maintains to this day. Generations of Brazilian growers mastered coffee farming across the states of Rio de Janeiro, São Paulo, and Minas Gerais, weathering boom-and-bust cycles known as cafés com leite politics in the early 20th century.

Even now, Brazil alone accounts for roughly 30–40% of global coffee production (around 65 million 60-kg bags annually in recent years). Historically renowned for mass volumes of arabica, Brazil has in recent years also cultivated huge crops of canephora (C. canephora var. conillon) – often misnamed as robusta. In fact, Brazil’s canephora output hit a record 21 million bags in 2024/25, and is forecast to reach 24.1 million bags in 2025/26 – an all-time high. This diversification helps Brazil adapt to climate stresses, as canephora can handle heat and lower elevations better than delicate arabica, though it remains highly susceptible to drought.

Following Brazil’s rise, other traditional coffee heartlands have left their mark. Colombia, with its verdant Andean slopes, became synonymous with high-quality mild arabica in the 20th century – personified by the marketing icon Juan Valdez. After a devastating coffee leaf rust outbreak in the 2010s, Colombia rebounded with rust-resistant varieties, though production has fluctuated with weather.

The latest USDA projections paint a pessimistic near-term picture: Colombian output may slip 5.3% to 12.5 million bags in 2025/26 (from 13.2 million bags the year before) due to unusually heavy rains disrupting flowering. Excessive rainfall from a persistent La Niña pattern dented Colombia’s crop, illustrating how even tropical highlands are not immune to climate variability. There is a silver lining – as La Niña fades, conditions are expected to normalise and monthly production should recover to average levels by late 2025.

But the episode underscores Colombia’s ongoing challenge: maintaining steady harvests amid erratic weather and aging trees. The National Federation of Colombian Coffee Growers (Fedecafé) continues to promote replanting with improved varieties, yet record-high prices in recent years perversely discouraged some farmers from renovating their farms (as many preferred to cash in on the current crop). Still, Colombia remains the world’s third-largest producer and a byword for quality in specialty coffee circles.

New Frontiers: Asia, Africa, and the Rise of Unlikely Producers

Expanded analysis by Qahwa World Editorial Team

While Brazil and Colombia still dominate global headlines, new frontiers of coffee production are quietly emerging across Asia, Africa, and even parts of Europe. These regions are not only reshaping the coffee supply map but also contributing to the diversification and resilience of the global coffee economy.

Vietnam, for example, has become the world’s second-largest coffee producer by volume—largely due to its high-yielding robusta cultivation in the Central Highlands. Introduced by French colonialists in the 19th century, coffee in Vietnam was industrialized in the 1990s, with state support and a focus on export markets. Today, Vietnam produces more than 27.5 million 60-kg bags annually and is gaining recognition for its experimental arabica lots from regions like Cau Dat and Son La.

India currently produces around 5.8 million 60-kg bags of coffee per year, grown across more than 400,000 small and medium-sized farms, mainly in the states of Karnataka, Kerala, and Tamil Nadu. Roughly 70% of this is robusta and 30% arabica. Regions like Chikmagalur and Wayanad are leading efforts to produce high-quality washed, natural, and monsooned coffees that appeal to the growing specialty market.

China, meanwhile, has emerged as one of the fastest-growing coffee producers over the past two decades, particularly in Yunnan Province. For the 2024/25 season, China’s total output reached around 2.3 million 60-kg bags, with strong potential for future growth. Backed by rising domestic demand—especially in cities like Shanghai and Beijing—the government is supporting the expansion of local arabica farms and promoting quality-focused production aimed at both domestic and international specialty markets.

In Africa, countries like Rwanda, Burundi, and Uganda are redefining the continent’s role beyond Ethiopia. Uganda, traditionally known for robusta, has made strategic investments in arabica production in Mount Elgon and Rwenzori regions. Rwanda’s government has partnered with international NGOs to implement rigorous washing station protocols and traceability systems that have elevated its status among specialty buyers.

Even non-traditional regions are entering the coffee landscape. In southern Europe, small experimental plots in Spain, Italy, and Portugal are producing limited batches of arabica under controlled microclimates—raising questions about whether climate change could shift coffee zones northward.

Climate Change and Financial Volatility

As new frontiers open, climate uncertainty looms large over both old and emerging regions. Arabica is particularly vulnerable to erratic weather patterns, higher temperatures, and shifting rainfall. While higher elevations in Colombia or Ethiopia may offer temporary buffers, many producers are already being forced to migrate to higher altitudes, change varieties, or invest in costly adaptation measures.

Robusta, being more heat-tolerant, has become a strategic hedge for many countries. Yet even robusta is susceptible to prolonged droughts, as witnessed in Brazil’s Espírito Santo in recent years. As the ICO Coffee Development Report 2023 noted, adaptation costs are steep and disproportionately affect smallholders—particularly in countries without robust agronomic support.

The climate-linked production volatility has turned coffee into a favorite target for financial speculation. Hedge funds and commodity traders, watching weather patterns and export data, often amplify price swings through futures contracts. The result: producers face whiplash from global prices that may bear little relation to their actual cost of production. While some cooperatives and large estates can hedge or use fixed contracts, smallholders remain vulnerable to market shocks—particularly in emerging producer countries lacking access to finance.

The Consumer’s Role: From Commodity to Craft

Parallel to these production shifts is a transformation in consumer behavior—arguably the most influential force in today’s coffee industry.

A new generation of drinkers, especially in urban centers across Asia, the Middle East, and Africa, is demanding traceable, sustainably grown, and ethically traded coffee. From Seoul to Nairobi, consumers are asking not just how their coffee tastes, but who grew it, how it was processed, and whether it benefits the environment and the farmer.

In response, origin stories, varietals, and post-harvest methods now play a central role in marketing. Microlots, natural and anaerobic fermentation, and experimental drying techniques have become signatures of high-end cafés and roasters. Specialty-focused roasters from the UAE to Japan are forging direct relationships with producers in both traditional and emerging origins, bypassing legacy supply chains in favor of transparency and quality control.

This consumer-driven evolution is also accelerating digital traceability platforms, blockchain pilots, and sustainability scoring systems. While promising, these systems risk excluding producers without the technical or financial means to participate—creating new forms of inequality within the coffee world.

Looking Ahead: A Polycentric Coffee Future

As we look to the next decade, the coffee map will likely become more polycentric: no longer dominated solely by Brazil or Colombia, but enriched by contributions from Vietnam, China, Uganda, and beyond. Climate resilience, supply chain innovation, and consumer activism will shape which origins thrive and which falter.

Coffee’s future lies not in the past glories of empire or monoculture, but in adaptation, collaboration, and shared value. From the highlands of Ethiopia to the foothills of Yunnan, and from São Paulo’s cafés to Kigali’s washing stations, the journey of coffee is far from over. It is evolving—one origin, one cup, one choice at a time.

Editor’s Note

The first half of this article was written by Dr. Steffen Schwarz of Coffee Consulate. The latter sections were expanded by Qahwa World’s editorial team to include recent data, market developments, and expert analysis.