Global Coffee Market Shows Mixed Signals Amid Supply Shifts and Price Stabilization

The global coffee market continued its complex trajectory in May 2025, with slight adjustments in prices and exports reflecting the delicate balance between improving supply chains, mixed demand trends, and broader economic uncertainties.

According to the latest Coffee Market Report released by the International Coffee Organization (ICO), the ICO Composite Indicator Price (I-CIP) averaged 334.41 US cents per pound in May—slipping by just 0.4% compared to April. Despite this minor decline, prices remain significantly elevated year-over-year, standing 60.5% higher than in May 2024.

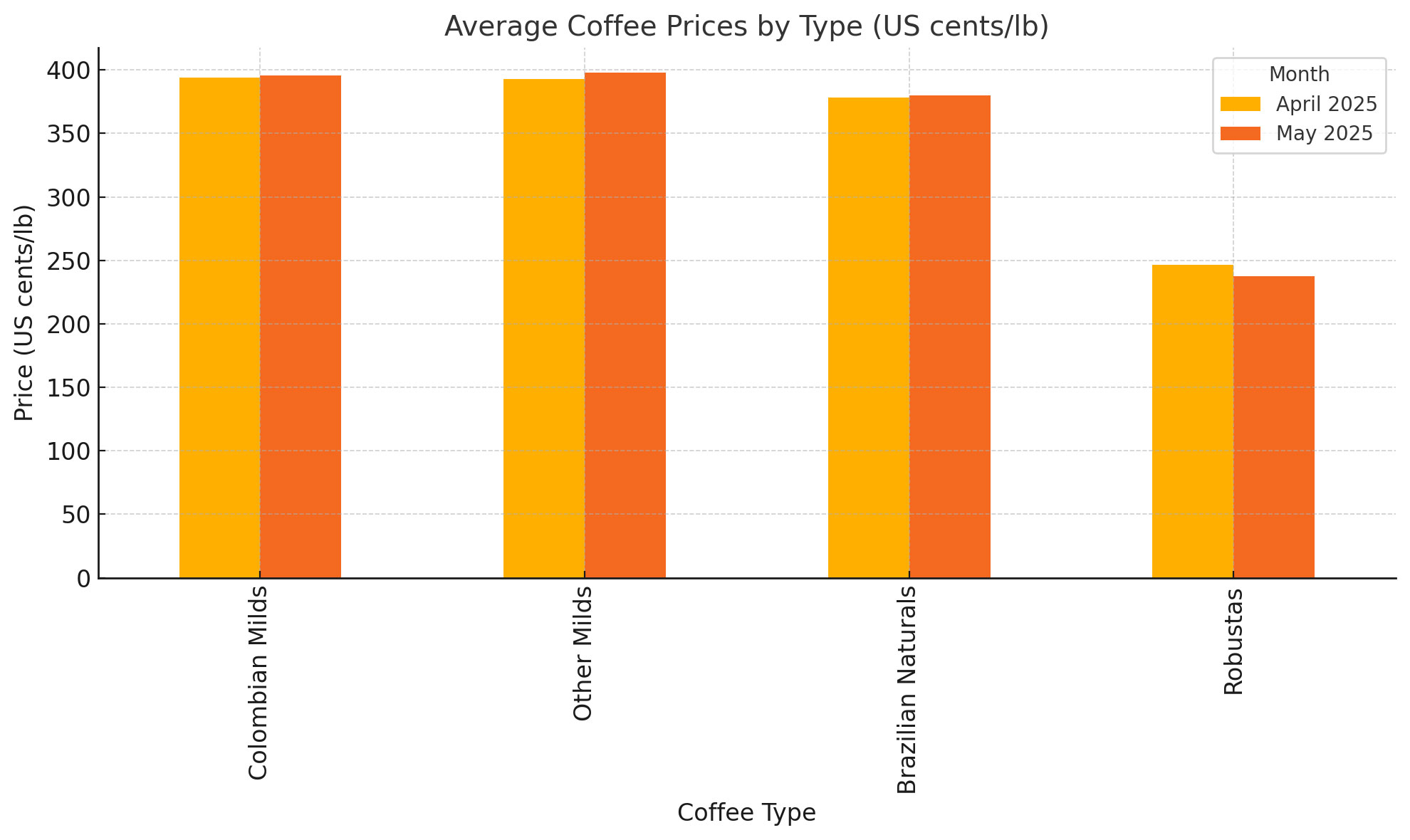

Arabica Holds Ground, Robusta Retreats

While Robusta coffee experienced a notable 3.5% price decline, dipping to 237.76 US cents/lb, Arabica varieties saw modest gains:

-

Colombian Milds: 395.59 US cents/lb (+0.4%)

-

Other Milds: 397.84 US cents/lb (+1.3%)

-

Brazilian Naturals: 380.02 US cents/lb (+0.5%)

The arbitrage between New York and London futures widened by 6.6% to 143.58 US cents/lb. Meanwhile, market volatility stabilized slightly, with I-CIP intra-day variation averaging 11.1%.

Shifting Export Patterns: Brazil Slows, Africa Surges

Global green coffee exports in April 2025 totaled 10.2 million bags, down 6.8% from April 2024. The decline was largely driven by a 14.4% drop in Brazilian Naturals. Robustas also decreased by 5.8%, primarily due to Brazil’s dramatic 86.4% fall in Robusta exports.

In contrast, the Colombian Milds and Other Milds categories grew modestly, with Kenya and Ethiopia leading the gains. Kenyan exports soared 14%, marking a 24-year record for the country.

The share of Arabica in total green bean exports increased from 59.9% to 63.3%, further underscoring consumer preference for higher-end coffee despite inflationary pressures.

Regional Highlights

-

Africa: Exports surged 30.2% to 1.8 million bags. Ethiopia and Uganda led the way, buoyed by strong harvests and high global prices.

-

Asia & Oceania: Up 8.3%, with Indonesia and Vietnam showing double-digit growth in response to elevated Robusta prices.

-

South America: Down 28.4% as Brazil’s exports fell sharply, partly due to ongoing port delays. This marked the sixth consecutive month of decline.

-

Mexico & Central America: Grew 4.1%, potentially signaling the start of a new up-cycle after years of decline.

Roasted and Soluble Coffee Rising

Processed coffee exports reflected growth as well. Soluble coffee exports rose 6% to 1.13 million bags in April 2025, with Brazil leading the segment. Roasted coffee beans surged 16.4%, reaching 87,619 bags compared to 75,253 bags in April 2024.

Soluble coffee’s share of total coffee exports rose to 9.5%, up from 8.8% a year earlier—demonstrating rising global demand for convenient coffee products.

Futures Market Update: Major Contract Shift Ahead

A major structural change was also announced: ICE Futures U.S. will phase out the Coffee “C” contract by March 2028. The new Arabica contract will be priced in USD per metric tonne and allow the use of Flexible Intermediate Bulk Containers (FIBCs), aiming to modernize the coffee futures market.

Mixed Market Signals: What Lies Ahead?

The report identified several bullish and bearish indicators shaping the near-term outlook:

Bullish:

-

Strong U.S. consumer spending supported by low household debt.

-

JDE Peet’s announcement of possible retail price hikes, signaling sustained demand.

Bearish:

-

USDA forecasts indicate increased supply from Brazil (+0.2%) and Peru (+8%).

-

Neutral El Niño conditions bode well for harvests in Latin America.

-

Geopolitical improvements in the Red Sea (Houthi ceasefire) are enhancing logistics and reducing shipping delays.

-

Concerns persist over U.S. trade tariffs and potential recessionary effects.

Inventory Rebound

Certified coffee stocks rebounded in May:

-

Arabica (New York): +9.4% to 0.93 million bags

-

Robusta (London): +28.1% to 0.92 million bags

These increases suggest improved logistics and short-term supply availability.

Conclusion

May 2025 brought stabilization rather than disruption to the global coffee market. Arabica continues to dominate global exports, while African and Southeast Asian producers have capitalized on global price dynamics. As the market transitions into the second half of the year, attention will turn to weather patterns, economic signals, and the evolving futures market structure to gauge where prices and demand are headed.

📊 Download the full report here

📈 Explore price visuals and regional breakdowns on QahwaWorld.com