Global coffee markets witnessed significant fluctuations in February 2025, with the International Coffee Organization’s Composite Indicator Price (I-CIP) achieving an unprecedented high of 354.32 US cents/lb, representing a 14.3% increase from January and surpassing the historical peak set in March 1977. This remarkable rise underscores the intense volatility and economic factors influencing the coffee sector.

The substantial rise in coffee prices was driven primarily by the Colombian Milds and Other Milds categories, which surged by 16.7% and 15.5%, respectively, reaching 410.64 and 409.48 cents/lb. Brazilian Naturals also saw an 18.3% increase to 401.10 cents/lb, while Robusta prices rose modestly by 7.2% to 263.08 cents/lb. The price differentials exhibited notable volatility, with the Colombian Milds–Other Milds differential reversing from negative territory to positive territory, indicating shifting market preferences and supply dynamics.

Global green bean exports showed a pronounced contraction of 14.2%, totalling 9.72 million bags in January 2025, marking the third consecutive monthly decline. Notably, Robusta exports plummeted by 27.5%, driven by a substantial 43.8% drop in Vietnam’s exports due to domestic supply constraints and historical export anomalies from the previous year.

In contrast, Africa demonstrated robust performance, with exports growing 7.1%, led by Côte d’Ivoire and Uganda, who collectively increased shipments by 28.1%. This growth offset some of Vietnam’s shortfalls. Meanwhile, exports from Asia & Oceania sharply declined by 31.9%, largely attributed to Vietnam’s reduced export volumes, though Indonesia partially mitigated this decline with a 47.4% increase in shipments.

Mexico and Central America collectively experienced a positive shift, with exports increasing by 10.9%. Costa Rica, Guatemala, Honduras, and Nicaragua played pivotal roles in this upturn. However, Mexico saw an export reduction of 13.6%, largely linked to rising soluble coffee production, diverting green beans from international markets.

South America reported a 4.2% reduction in exports due to Peru’s dramatic 58.9% decline, attributed to depleted stock levels following heightened demand and supply pressures from Ethiopia earlier in the year.

Export data also revealed changes by coffee form, with soluble coffee exports decreasing by 5.2%, while roasted coffee exports rose slightly by 1.4%.

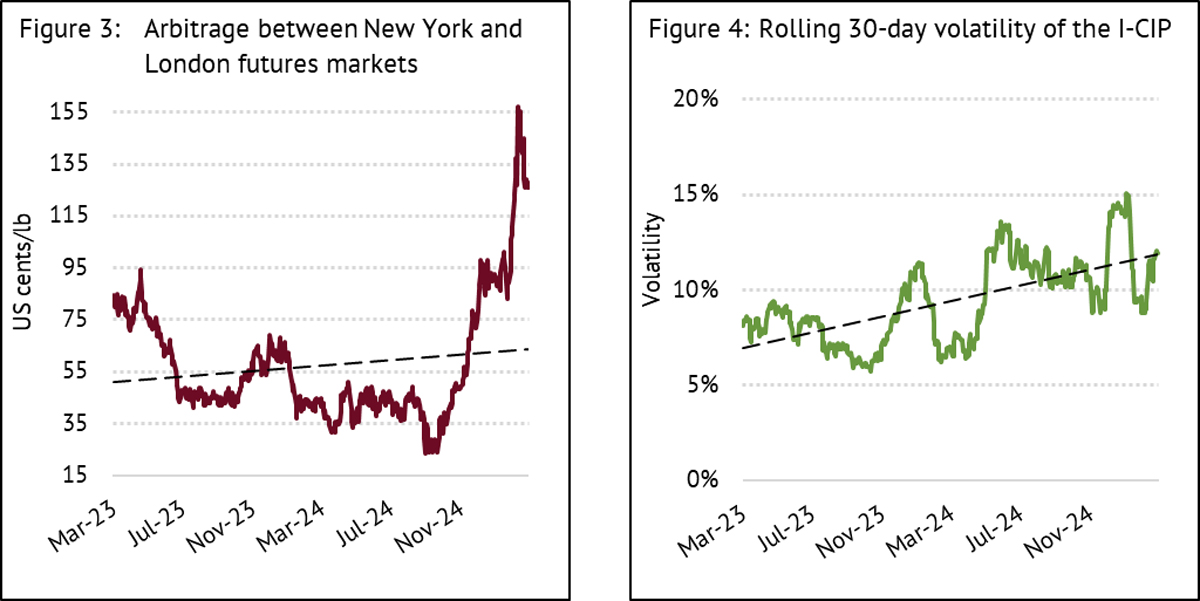

Several factors underpinned the volatility seen in February, including economic uncertainties arising from negative business and consumer sentiment reports from the US and EU. Increased margin requirements imposed by ICE on Arabica futures contracts further pressured traders, prompting position liquidations and market corrections. Moreover, rising US tariffs and financial constraints due to trader liquidity issues led to diminished market purchasing power, notably illustrated by the bankruptcies of Brazilian traders Atlântica Exportação e Importação SA and Cafebras Comércio de Cafés do Brasil SA.

Preliminary forecasts for Vietnam’s 2024/25 harvest indicate an improved outlook, with a projected 10% production increase, offering some relief to the global supply concerns exacerbated by previous shortages and adverse weather conditions. Additionally, the expected transition from a strong El Niño to La Niña conditions could stabilize supply dynamics further in the coming months.

The market shifts observed underscore the interconnectedness and complexity of global coffee trade dynamics, highlighting how intertwined economic, climatic, and regional factors impact pricing, supply, and market stability.

Stay informed on ongoing developments and explore the comprehensive analysis of global coffee trends and forecasts for the coming months.