دبي، 6 أغسطس 2025 (قهوة ورلد) – في تحوّل لافت بمسار السوق العالمي، سجّلت أسعار القهوة انخفاضات حادة في يوليو 2025، وسط مؤشرات على فائض بالإنتاج وعودة توازن الإمدادات في عدد من الدول الكبرى. التقرير الشهري الصادر عن منظمة القهوة الدولية كشف عن تراجع جماعي في أسعار جميع أنواع القهوة، بالتوازي مع ارتفاع في صادرات الروبوستا والقهوة القابلة للذوبان، وتراجع في صادرات أمريكا الجنوبية.

ويأتي هذا الانخفاض، الذي ترافق مع توتر في الأسواق العالمية إثر سياسات جمركية جديدة، ليؤكد أن صناعة القهوة تمر بمرحلة إعادة تموضع، تُعيد توزيع أدوار الدول المصدّرة، وتدفع باتجاه أنماط استهلاك جديدة.

انخفاضات جماعية في الأسعار رغم المكاسب السنوية

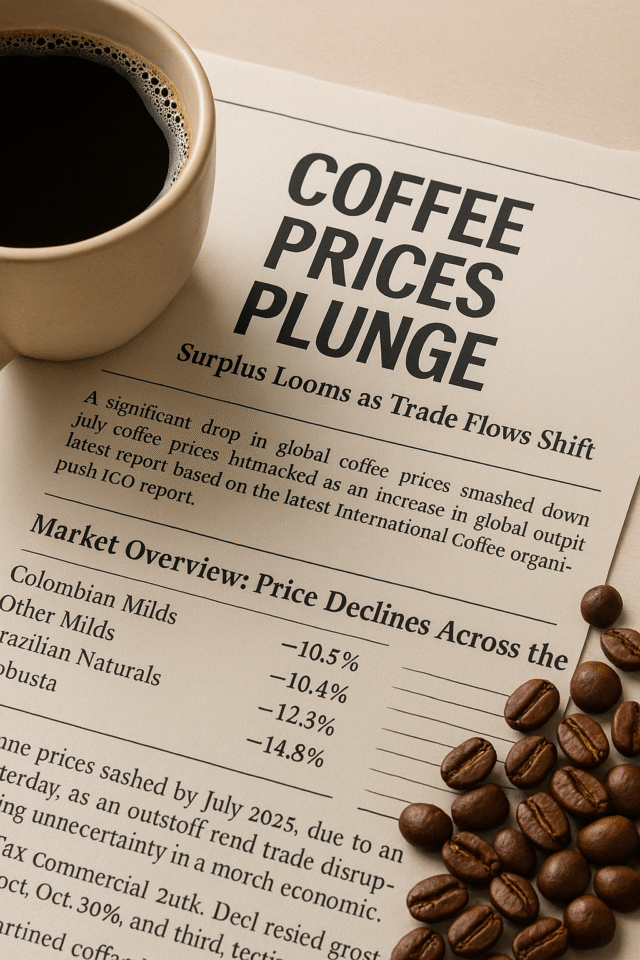

سجّل مؤشر الأسعار المركب (I-CIP) لمنظمة القهوة الدولية متوسطًا قدره 259.31 سنتًا أمريكيًا للرطل في يوليو، متراجعًا بنسبة 11.8% مقارنة بشهر يونيو. وعلى الرغم من هذا الهبوط الشهري، لا يزال المؤشر أعلى بنسبة 9.6% مقارنة بالفترة ذاتها من العام الماضي.

وشملت الانخفاضات جميع أنواع القهوة، كما يلي:

-

الكولومبية المعتدلة: 322.37 سنتًا/رطل (–10.5%)

-

الأنواع المعتدلة الأخرى: 325.50 سنتًا/رطل (–10.4%)

-

البرازيلية الطبيعية: 297.04 سنتًا/رطل (–12.3%)

-

الروبوستا: 167.19 سنتًا/رطل (–14.8%)

وفي أسواق العقود الآجلة، سجلت بورصة نيويورك أدنى مستوى لها في تسعة أشهر عند 289.17 سنتًا، بينما تراجعت بورصة لندن بنسبة 16.3% لتصل إلى 153.43 سنتًا.

أربعة عوامل تضغط على السوق

كشف التقرير عن مجموعة من العوامل التي ساهمت في دفع الأسعار نحو الهبوط، أبرزها:

-

تحسن الإنتاج العالمي وتوقعات فائض خلال موسم 2024/2025.

-

تسارع الحصاد في البرازيل، حيث بلغت نسبة الإنجاز 84% حتى 23 يوليو.

-

السياسات التجارية الأمريكية الجديدة، والتي قد تؤثر سلبًا على الناتج العالمي بنسبة 1.1% بحلول عام 2030.

-

ارتفاع المخزونات العالمية، لا سيما في الروبوستا (زيادة بنسبة 35.8%).

تقلبات السوق والفروقات السعرية

شهدت السوق استقرارًا نسبيًا في تقلبات الأسعار، حيث بلغ معدل تقلب المؤشر المركب 10.2%، بينما ارتفعت تقلبات الروبوستا إلى 13.1%. أما الفروقات بين أنواع القهوة فقد اتجهت نحو التقلص، باستثناء الفارق بين الكولومبية المعتدلة والبرازيلية الطبيعية، الذي ارتفع بنسبة 17.5% إلى 25.32 سنتًا/رطل.

تزايد الصادرات في آسيا وأفريقيا وتراجع حاد في البرازيل

رغم انخفاض الأسعار، ارتفعت صادرات القهوة الخضراء بنسبة 3.3% في يونيو، لتصل إلى 10.23 مليون كيس. أما على المستوى الإقليمي، فقد كانت آسيا وأفريقيا الأبرز من حيث النمو:

-

آسيا وأوقيانوسيا: +38.6%، بقيادة فيتنام (↑64.6%) وإندونيسيا (↑63.2%)

-

أفريقيا: +28.1%، بفضل أوغندا (↑51.4%) وإثيوبيا (↑15.0%)

-

أمريكا الجنوبية: –18.1%، مع تراجع صادرات البرازيل بنسبة 31.4%

-

أمريكا الوسطى والمكسيك: +18.0%، بقيادة نيكاراغوا (↑50.6%)

نمو لافت في صادرات القهوة القابلة للذوبان

ارتفعت صادرات القهوة القابلة للذوبان بنسبة 47.2% في يونيو، لتصل إلى 1.35 مليون كيس، وشكلت 11.5% من إجمالي الصادرات حتى تاريخه، مقارنة بـ 8.9% العام الماضي. وكانت البرازيل أكبر مصدر لهذا النوع بـ 0.30 مليون كيس.

كما ارتفعت صادرات القهوة المحمّصة بنسبة 58.1% لتصل إلى 0.08 مليون كيس.

عقد جديد للأرابيكا يدخل حيّز التداول

أعلنت بورصة ICE الأمريكية عن إطلاق عقد جديد للقهوة الأرابيكا بوزن 10 أطنان مترية (الرمز AC)، وذلك بدءًا من 8 سبتمبر 2025. ويشمل العقد 20 دولة من بينها: البرازيل، كولومبيا، فيتنام، إثيوبيا، الهند، كينيا، وبيرو.

الخلاصة.. صناعة القهوة أمام مرحلة جديدة

يؤكد تقرير يوليو 2025 أن قطاع القهوة العالمي يقف أمام مرحلة إعادة تشكيل كبرى. وبينما تنحسر هيمنة البرازيل مؤقتًا، تتقدم فيتنام وأوغندا وإثيوبيا لتكون قوة دفع جديدة في السوق. وفي المقابل، تعكس الطفرة في صادرات الروبوستا والقهوة القابلة للذوبان تحولًا في تفضيلات المستهلكين نحو منتجات أكثر تنوعًا وأقل تكلفة.

ومع اقتراب نهاية موسم 2024/2025، يبدو أن الأشهر المقبلة ستكون حاسمة في تحديد اتجاهات الأسعار والتجارة والطلب في هذا القطاع الذي لا يزال يحتفظ بأهميته الاقتصادية والثقافية على مستوى العالم.