Indonesia projects 5% growth in coffee production for 2025/2026, reaching 11.3 million bags. Robusta dominates output, exports rise 7%, but domestic consumption slows amid weak spending.

According to the Coffee Annual Report – Indonesia 2025/2026, published by the U.S. Department of Agriculture on May 19, 2025, Indonesia’s coffee production is forecast to reach 11.3 million 60-kg bags, marking a 5% increase over the previous year. This growth is attributed to favorable weather during the flowering season and improved farm inputs. However, despite higher production and a 7% rise in exports, domestic consumption remains sluggish due to weak middle-class spending.

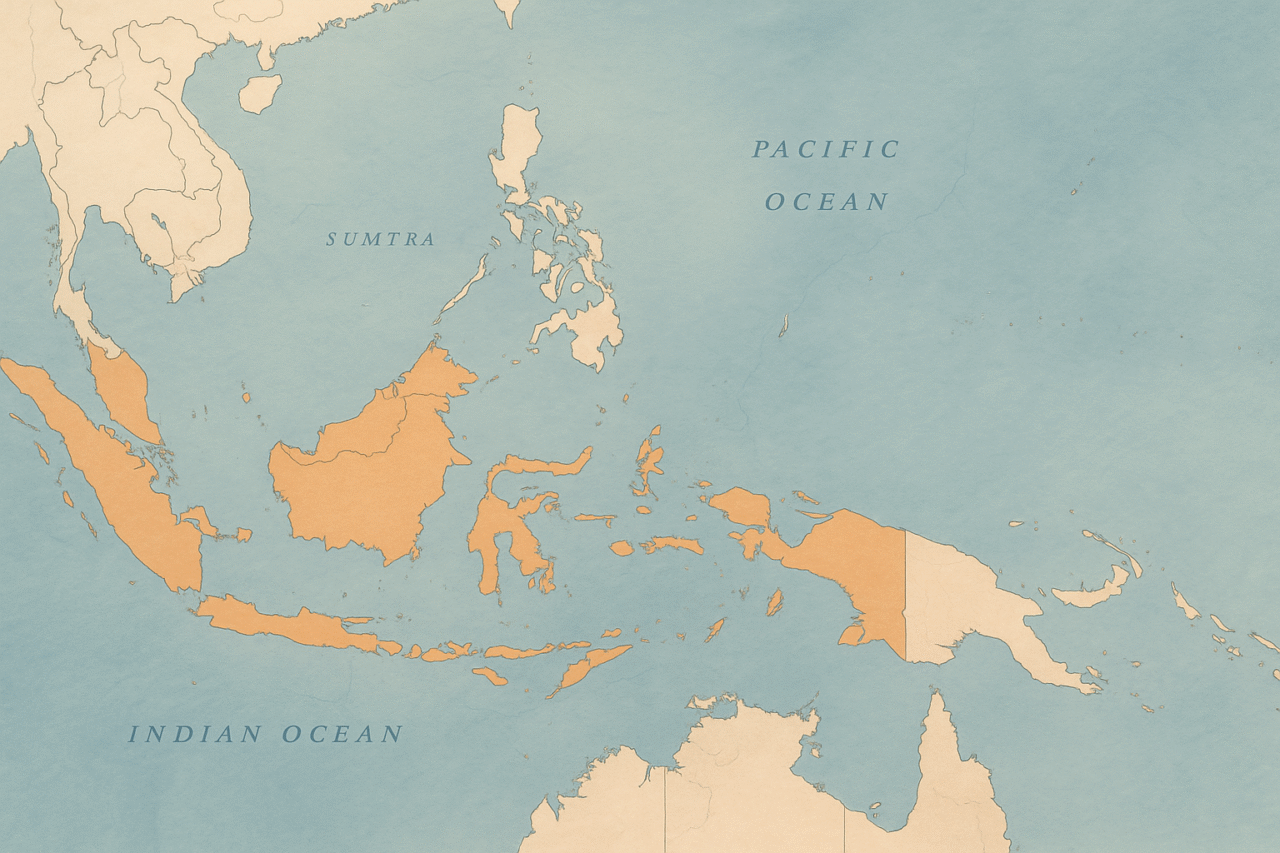

Indonesia’s total planted area remains unchanged at 1.2 million hectares, as no major expansion or replanting initiatives have been introduced in recent years. Smallholder plantations—typically between one and two hectares—continue to dominate the sector, accounting for 98% of total area. Larger estates, managed by private and state-owned companies, are located primarily in Sulawesi, Sumatra, and East Java.

The island of Sumatra remains the heart of Indonesia’s coffee belt, producing 70–75% of the country’s total output, with the majority being robusta from provinces like South Sumatra, Lampung, and Bengkulu. Arabica production is centered in North Sumatra, as well as high-altitude zones in Java, Sulawesi, and Papua.

In 2025/2026, robusta production is expected to increase by 500,000 bags, reaching 9.8 million bags, driven by improved rainfall and increased fertilizer use. Farmers in Jambi and South Sumatra began harvesting in late April 2025, with peak harvest expected between June and July. Meanwhile, arabica production is projected to reach 1.45 million bags, showing a slight increase. Arabica is harvested twice annually—in April/May and again in September/October.

Improved margins from rising prices over the past two years have motivated smallholders to rejuvenate neglected plots and adopt better farm practices. In regions like Lampung, fertilizers and pesticides are often accessed on credit through village-level aggregators. Family labor is commonly used, with rotational harvesting labor helping reduce overall costs.

Despite this, yields—especially for robusta—remain below one ton per hectare, constrained by inconsistent seed quality and a limited supply of improved planting material. Local government support for better seedlings and training programs remains geographically limited.

Domestic consumption in 2025/2026 is forecast at 4.81 million bags, up slightly by just 10,000 bags. While roasteries and processors continue to show demand, many were pressured by rising input costs and subdued consumer purchasing power during 2024/2025. Lower- to mid-grade coffee products are expected to perform better, particularly among working-class and Gen Z consumers in urban areas. Street vendors and hawkers selling affordable coffee maintain steady sales, while high-end cafés remain popular with younger and higher-income demographics.

Ready-to-drink (RTD) coffee sales continue to grow—albeit at a slower pace. In 2025, RTD volume is projected to increase by 3%, the slowest rate since the pandemic. These products, often priced more accessibly than those at branded coffee chains, have become increasingly popular in convenience stores and vending machines.

On the trade front, green bean exports are forecast to increase to 6.5 million bags, up from 6.1 million last year. The growth comes from improved availability following the production rebound. However, uncertainty surrounds shipments to the United States, which had resumed during a temporary tariff pause but may face disruption after July 2025. Exporters are bracing for the expiration of a 90-day suspension on a reciprocal 32% tariff, and are actively redirecting shipments to alternative destinations such as ASEAN countries, Japan, the EU, and the Middle East.

In 2024/2025, exports to the U.S. reached 726,000 bags, a 23% increase over the prior year. The EU remained the top buyer, driven by demand from Belgium and Germany, with over 1.4 million bags shipped between March 2024 and February 2025—double the volume from the previous year. However, the upcoming EU Deforestation Regulation (EUDR) poses new compliance challenges. Exporters are now preparing to meet stricter traceability and sustainability requirements, including the need to provide due diligence statements certifying that coffee is deforestation-free.

Green bean imports, mostly of robusta from Vietnam and arabica from Brazil, are projected to fall to 400,000 bags in 2025/2026 as local availability improves. During the 2024 period, imports from Vietnam dropped to 490,000 bags, while Brazilian imports stood at 180,000 bags.

As for pricing, domestic bean prices have soared. Robusta spot prices in Lampung exceeded IDR 222,000/kg in early 2025, up sharply from IDR 55,000–70,000/kg the year before. Arabica spot prices in Medan surpassed IDR 213,000/kg in April and May. This price spike is tied to global market trends and lower stocks in late 2024, when many farmers held back supplies in anticipation of continued increases.

Despite these high prices, the use of high-yield, disease-resistant seedlings remains limited, and yield gaps persist across regions. Heavy rains and strong winds during cherry development continue to pose risks, especially for arabica grown in highland areas. However, weather during the flowering season was favorable, particularly from October to November 2024, boosting optimism for the current cycle.

As the Indonesian coffee sector moves into the 2025/2026 cycle, modest production gains, a resilient robusta base, and improved inputs set a stable foundation. But policy uncertainty, export redirection, price volatility, and looming EU regulations demand adaptive strategies. Strengthening farmer support programs, modernizing planting systems, and expanding traceability infrastructure will be key to sustaining momentum in the seasons ahead.