The European Coffee Report 2023/2024 reveals profound changes in Europe’s coffee trade dynamics, highlighting a sharp decline in green coffee imports and the emergence of new export markets for European producers. Published by the European Coffee Federation, this report captures the challenges facing the sector, including economic pressures, geopolitical disruptions, and shifting coffee consumption patterns.

Statistics indicate that total green coffee imports into Europe are projected to reach 3.3 million tonnes in 2023, marking a 20% drop compared to the peak in 2016. This sharp decline can be attributed to the European economic slowdown and changes in maritime trade priorities. Ports like Rotterdam in the Netherlands have taken precedence over traditional hubs such as Antwerp in Belgium. Germany, still Europe’s largest green coffee importer, reported a significant 17.1% decrease in imports, reflecting mounting pressures on the region’s largest economy.

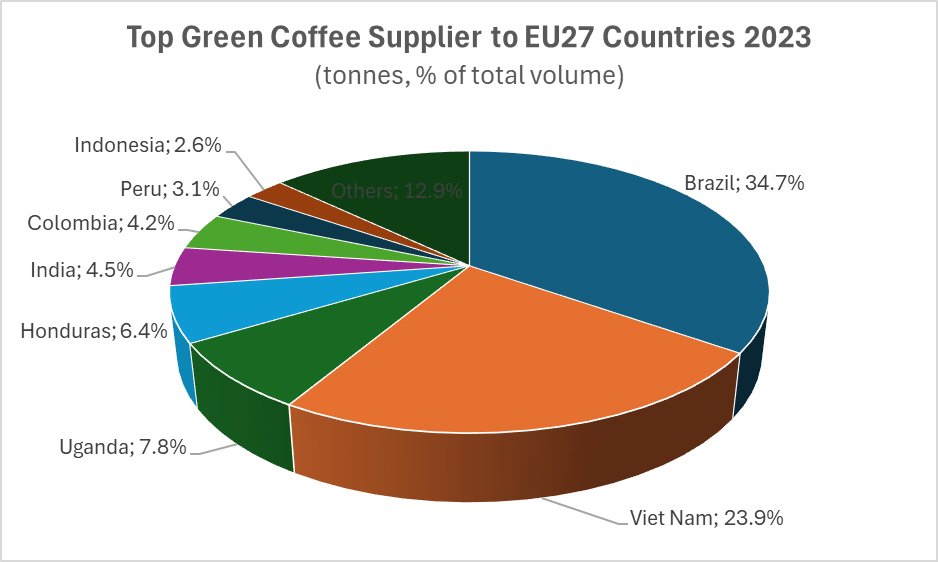

On the supply side, Brazil and Vietnam have maintained their dominance as Europe’s primary coffee suppliers. However, Brazil saw an 11.5% drop in exports due to frost that severely impacted crops. Vietnam, on the other hand, strengthened its market share to 23.9%, driven by robust robusta production. Remarkably, Papua New Guinea recorded a 32% growth in exports, while China’s coffee exports to Europe plummeted by 69% due to its increasing focus on the domestic market.

Exports tell a different story, with European coffee increasingly finding new markets. Post-Brexit, the United Kingdom emerged as the largest importer of roasted coffee from the EU, accounting for 18.2% of total exports. Countries like Türkiye and the UAE have also shown substantial growth in their imports of European coffee, reflecting a rising demand for high-quality products. Türkiye, in particular, recorded a 10.8% increase in roasted coffee imports, showcasing the dynamism of its market in absorbing European goods.

The report also highlights the growing popularity of soluble coffee, with EU exports of this segment rising by 7.1% in 2023. Key markets such as the United States and Türkiye played a pivotal role in driving this growth, fueled by shifting consumption habits that favor at-home brewing. Meanwhile, geopolitical tensions have negatively impacted coffee trade, with exports to Russia falling by 15.2% and Ukrainian imports decreasing by 11%, underscoring the sector’s vulnerabilities amid political instability.

The European Coffee Report 2023/2024 provides a comprehensive overview of a sector undergoing a transformative phase. As trade patterns shift and new markets emerge, stakeholders must focus on innovation, adopt sustainable practices, and adapt to new challenges to ensure the sector’s resilience in an evolving landscape.