Amsterdam, July 30, 2025 (Qahwa World) – JDE Peet’s, one of the world’s largest coffee and tea companies, has announced its financial results for the first half of 2025, showcasing robust growth across key performance indicators. The company recorded strong organic sales, solid profitability, and healthy free cash flow—despite continued volatility in green coffee prices.

🔹 Highlights for H1 2025

-

Organic Sales Growth: +22.5% (driven by +21.5% price and +1.0% volume/mix)

-

Reported Sales: €5,045 million (up 19.8%)

-

Organic Adjusted Gross Profit: +2.2% to €1,665 million

-

Reported Gross Profit: €1,537 million (down 8.7%)

-

Organic Adjusted EBIT: €709 million (up 2.0%)

-

Operating Profit: €402 million (down 40.2%)

-

Free Cash Flow: €565 million

-

Net Leverage: 2.5x

-

Underlying EPS: €1.33 (up 75.0%)

-

Reported EPS: €0.86 (up 16.2%)

-

Share Buyback: 38% of €250 million program completed

🔹 CEO Statement: Relevance Amidst Volatility

Rafa Oliveira, CEO of JDE Peet’s, expressed satisfaction with the company’s performance:

“We are very pleased with our business and financial results in the first half of 2025. Our performance was broad-based and strong across top-line, profitability, and cash flow, despite operating in a challenging environment marked by persistently high green coffee prices.”

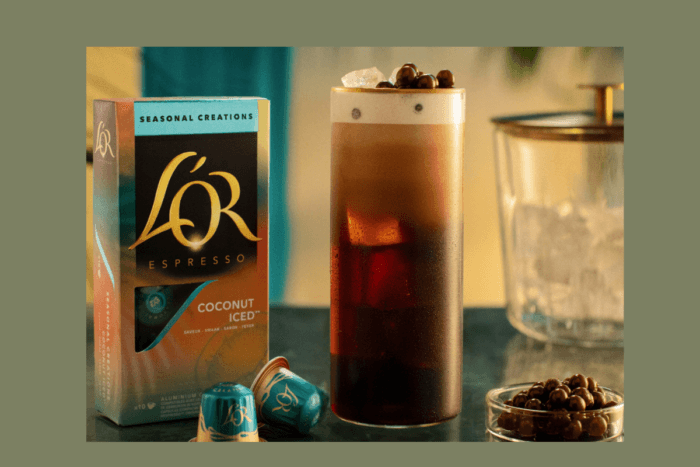

Oliveira highlighted recent product innovations—including Peet’s Popping Pearls, L’OR Coconut Iced Espresso, Jacobs Dubai Chocolate, and Moccona Liquid Espresso sachets—as key drivers for consumer engagement and market expansion.

🔹 Operational Restructuring and Strategic Progress

In line with its 2025 transformation goals, JDE Peet’s initiated several strategic changes:

-

Divested its tea business in Turkey to Efor Holding.

-

Halted the rollout of the L’OR Barista machine in the U.S.

-

Transferred the U.S. L’OR capsules business to Peet’s.

-

Announced the planned closure of the Banbury factory in the U.K.

-

Simplified its European model by reducing country clusters and centralizing finance operations under a Global Business Services framework.

These changes are part of the company’s focus on streamlining operations, enhancing resource allocation, and unlocking future growth.

🔹 New Strategy: “Reignite the Amazing”

Unveiled on July 1 at its Capital Markets Day, JDE Peet’s launched a bold new strategy—“Reignite the Amazing.” This brand-led framework focuses on three pillars:

-

Peet’s (North American specialty leader)

-

L’OR (global premium espresso brand)

-

Ten local icons, with Jacobs at the forefront

The company aims to:

-

Simplify its portfolio and operational model

-

Drive €500 million in cost savings by end-2027

-

Reinvest 50% of these savings into growth and innovation

-

Expand global reach via high-potential opportunities

🔹 Green Coffee Price Inflation

Green coffee prices surged by over 60% year-on-year during the first half of 2025, with easing in the final two months. JDE Peet’s continues to mitigate these cost pressures through efficiency improvements and selective price adjustments—while maintaining affordability for consumers and supporting sustainability among coffee farmers.

🔹 Share Buyback Update

As of July 25, 2025, the company has completed 38% of its €250 million share repurchase program, on track for full execution by year-end.

🔹 Upgraded 2025 Outlook

Based on first-half performance and expectations for the remainder of the year, JDE Peet’s has raised its full-year 2025 guidance:

-

Organic Sales Growth: high-teens (upgraded)

-

Adjusted EBIT: at least stable (upgraded)

-

Free Cash Flow: ~€1 billion (unchanged)