Dubai – Qahwa World

Chinese coffee chain Luckin Coffee is reportedly evaluating a potential acquisition of Blue Bottle Coffee, the specialty coffee brand majority-owned by Nestlé, as part of its strategy to strengthen its presence in the premium coffee segment.

Sources indicate that Luckin and its main investor, Centurium Capital, are pursuing moves to build a portfolio of premium coffee brands and expand their global footprint. This potential bid follows reports that Nestlé was considering selling its stake in the California-based Blue Bottle, which it acquired in 2017 for $425 million, valuing the company at roughly $700 million. Current estimates suggest the brand could now be sold at a lower price.

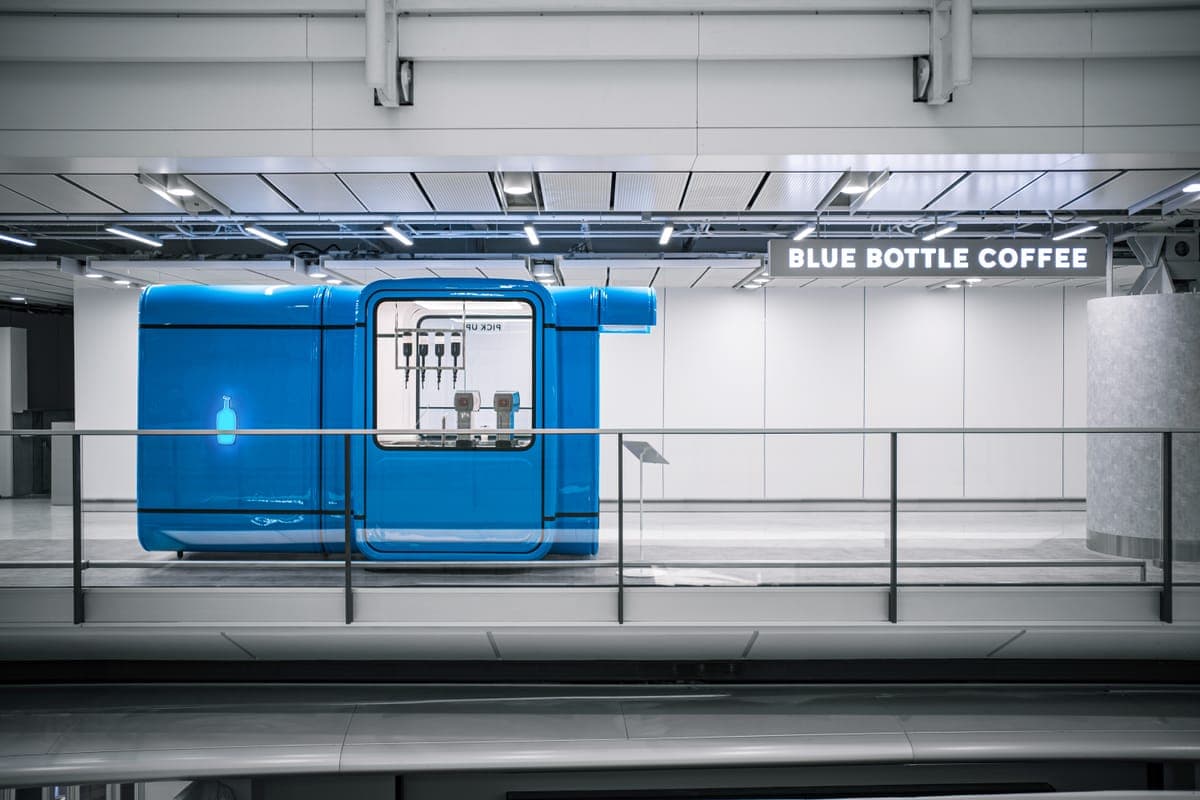

Blue Bottle Coffee operates over 100 boutique cafés in the United States and East Asia, including 12 locations in mainland China and four in Hong Kong.

In addition to Blue Bottle, Luckin and Centurium are said to be exploring a bid for Lucky Ace International Ltd., the holder of master franchise rights for Japanese specialty chain % Arabica in China and Hong Kong. % Arabica currently runs 84 outlets in mainland China and 15 in Hong Kong.

Centurium Capital, which had previously shown interest in Coca-Cola’s Costa Coffee, appears to have shifted focus toward the Luckin expansion strategy.

Luckin Coffee, China’s largest coffee chain with more than 29,000 stores nationwide, significantly outpaces its nearest competitor, Cotti Coffee. Centurium became Luckin’s controlling shareholder in January 2022, holding over 50% of voting rights, following previous investments that helped the company recover from accounting issues and restructure debt.

Beyond China, Luckin has expanded internationally with 68 stores in Singapore, 45 in Malaysia, and five in the United States. CEO Jinyi Guo announced in November 2025 that the company is preparing for a new public listing in the United States.